![]()

5 Hard Facts that Show Us How Industrial Buyers Buy Online

I talk to so many marketers in the industrial sector who have no hard data on their consumers’ behavior. Sure—they have the sales team who provides insight from their experiences, and maybe they have their own experience with existing customers, but rarely is this data measurable and analyzable.

While experience certainly enhances marketing campaigns, it still leaves a gaping hole in your marketing strategy: what about all those consumers who aren’t our customers yet? Is there a discrepancy between new leads and our current customer base? Could we be doing something differently to attract new leads?

That’s why GlobalSpec releases their annual report, "Digital Media Use in the Industrial Sector". This report gives us key insights into the behaviors of modern engineers and industrial buyers.

Let’s take a look at key facts about industrial buyers that are unveiled in the 2015 report and see how they help us build better industrial marketing campaigns.

1. Don’t let anyone tell you engineers and industrial buyers don’t shop online.

I still hear the myth that industrial professionals don't shop online far too often. I suspect it spawns from the fallacious logic “my best customers didn't find me online, therefore all other industrial customers probably don’t shop online”.

Once again, you can’t measure your potential leads only by your existing customers.

Your current customers might have been with you long before online shopping had really taken off in the industrial sector. Or maybe your current customers don’t shop online simply because you haven’t marketed to those who do buy industrial goods online.

According to GlobalSpec’s report:

“Seventy-one percent of technical professionals visit at least six websites each week for work-related purposes.”

77% list their primary use of the internet at work as “to find components, equipment, services and suppliers.”

GlobalSpec’s data confirms that the majority of engineers and industrial buyers are buying online. Don’t miss out on a huge market just because you haven’t had enough hits from it yet.

2. Online tops the list of most used resources in the industrial sector.

Not only do industrial consumers buy online, they do the majority of their research there as well. In the top 4 resources for industrial professionals, only printed catalogues represent non-digital media, and it rests at the bottom of the list.

- Search Engines (Google, etc.): 89%

- Supplier Websites: 75%

- Online Catalogues: 74%

- Printed Catalogues: 44%

No doubt the importance of a strong online presence is key for even industrial companies.

3. Industrial buyers behave similarly to most online consumers.

The behavior of industrial buyers follows a similar path as consumers in other sectors. This is called the buyer’s journey. Their consumption of online material for work-related purposes shows three major stages:

- Awareness / Research Stage: they are looking for more information on exactly what they need. They’re often researching a problem they’re having and looking for possible solutions.

- Consideration / Evaluation: This is where they compare possible solutions to determine the best option for their application.

- Decision / Purchasing Stage: they’re ready to buy. We see more vendor comparisons, spec comparisons and price comparisons.

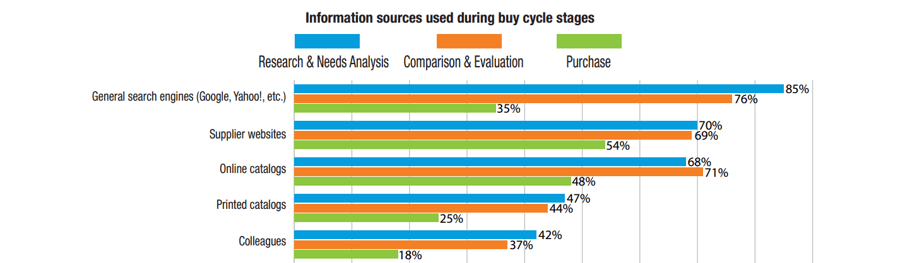

4. Where do industrial buyers go during each stage in their buyer’s journey?

For research and evaluations, search engines are key. Industrial consumers predominately search for their research and evaluation information.

It’s also no surprise that supplier websites are the most balanced option: a company’s website should offer ample content for buyers at any stage in the buyer’s journey. This way, potential buyers can find you no matter where they are.

The key takeaway is that industrial companies need not only content that closes sales, but content that’s appropriate for what consumers looking for before they buy.

5. Industrial buyers are waiting longer to talk to vendors.

58% of industrial buyers wait until the evaluation/purchase stages to contact a vendor

That means you can’t get them into your sales cycle early on in the journey through traditional methods.

You need content on your site to meet consumers’ needs during the research and consideration stages so you can even make an impression while industrial buyers mull over their information. That’s the best way for you to make an impression early.

A hypothetical journey:

Research Stage

Imagine an industrial engineer who is having a problem with dust accumulating the company’s ductwork. The buyer will go to a search engine to search “why is dust accumulating in my ductwork?” A buyer in this stage will want some content like “5 Common Sources of Dust Accumulation in Ductwork”.

Evaluation Stage

Our hypothetical engineer, after reading a few articles about dust accumulation in ductwork, has now discovered the problem: the company’s old dust collector isn’t powerful enough since their operation expanded.

So now they have to research dust collectors. What factors do they need to consider when buying a dust collector? Which codes do they need to follow when they purchase a new dust collector?

An article like “What You Should Know When Buying a New Dust Collector” might do well for this hypothetical engineer. At this point, the engineer might be looking via search engines or via the websites that provided him the best answers in the research stage.

Purchase Stage

Now the hypothetical engineer knows some things to look out for when buying dust collectors. The company has developed a set of specs the dust collector must meet.

So now the engineer goes to dust collector manufacturer’s websites to compare specs. He’ll be asking: can this manufacturer meet our specs? The engineer then asks for quotes from companies for a final price evaluation before purchasing.

The engineer will likely look at a vendor’s website or online catalogues.

Conclusion

The takeaway from GlobalSpec’s report should be that the online market continues to grow in the industrial sector.

Industrial companies need to build a strong online presence through diverse marketing channels to ensure they’re found where consumers are looking.

The core to getting found, though, is content strategy. Companies need to capture industrial professionals’ attention no matter where they are in the buyer’s journey. Online buyers want content. They want answers. Companies should give them what they want.

If you’re familiar with Inbound Marketing, this will come as no surprise. Inbound marketers have been implementing content strategies around buyer’s journeys for years. What’s really exciting, though, is to confirm with strong data that even industrial buyer’s follow the same path.

Many industrial companies still struggle to catch up with online marketing strategies, but the data is in: industrial companies need a powerful inbound strategy if they want to compete.